2024 Schedule 1 2024 Deductions – Taxpayers can take advantage of numerous tax deductions, also known as tax write-offs, to lower their tax bill or receive a refund from the IRS come tax season. Learn More: Trump-Era Tax Cuts Are . Complete Form 1040, attach Schedule 1, and add the amount to Line 18 under Adjustments to Income. Teachers can catch a break with this deduction. Educators, including counselors and principals .

2024 Schedule 1 2024 Deductions

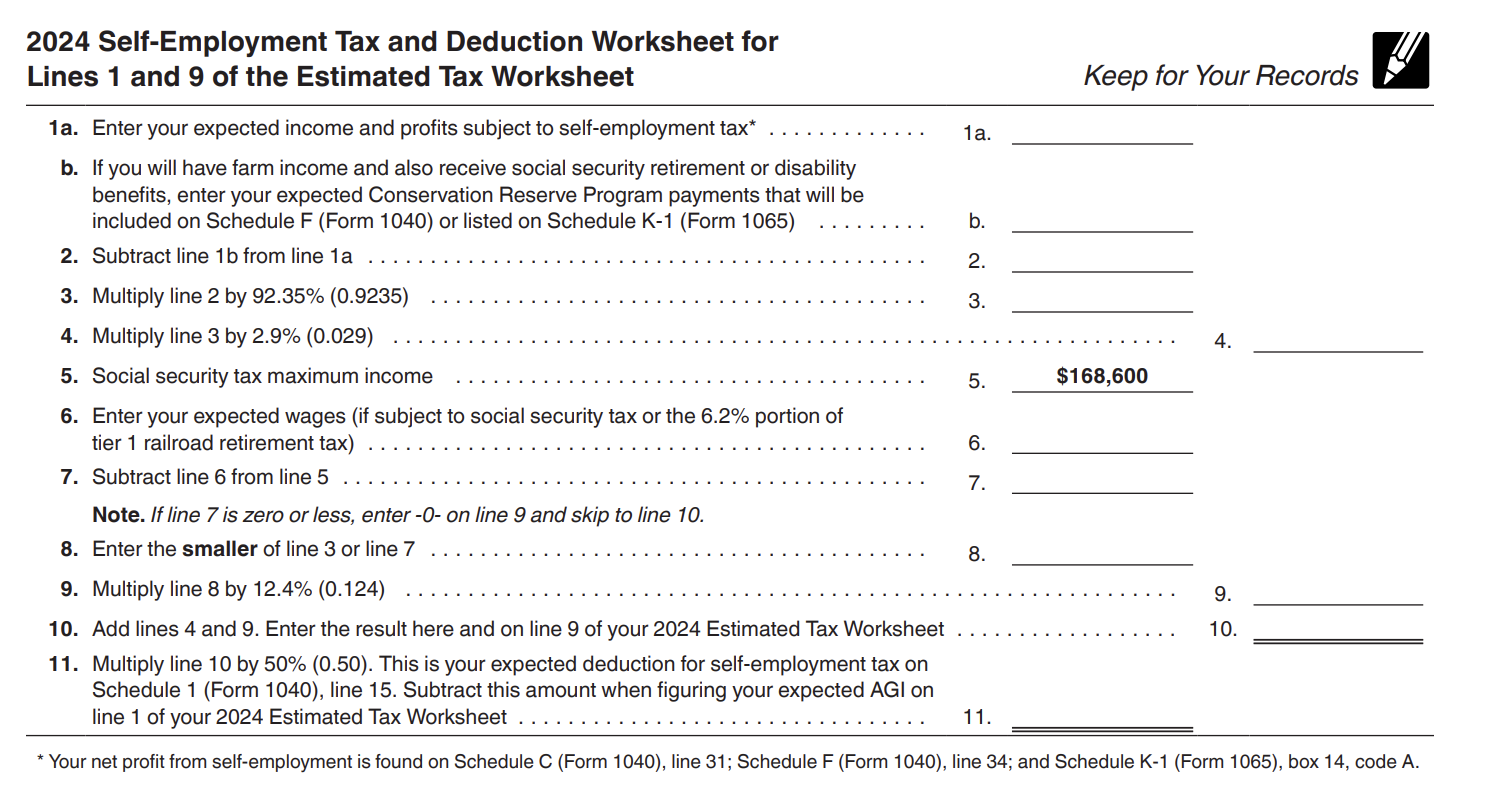

Source : 420cpa.comEstimated Taxes, Due Dates and Safe Harbor Tax Rules (2024)

Source : wallethacks.comF1 2024 teams, drivers, dates: Formula 1 race, schedule and line

Source : www.skysports.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govIRS Announces 2024 Tax Brackets, Standard Deductions And Other

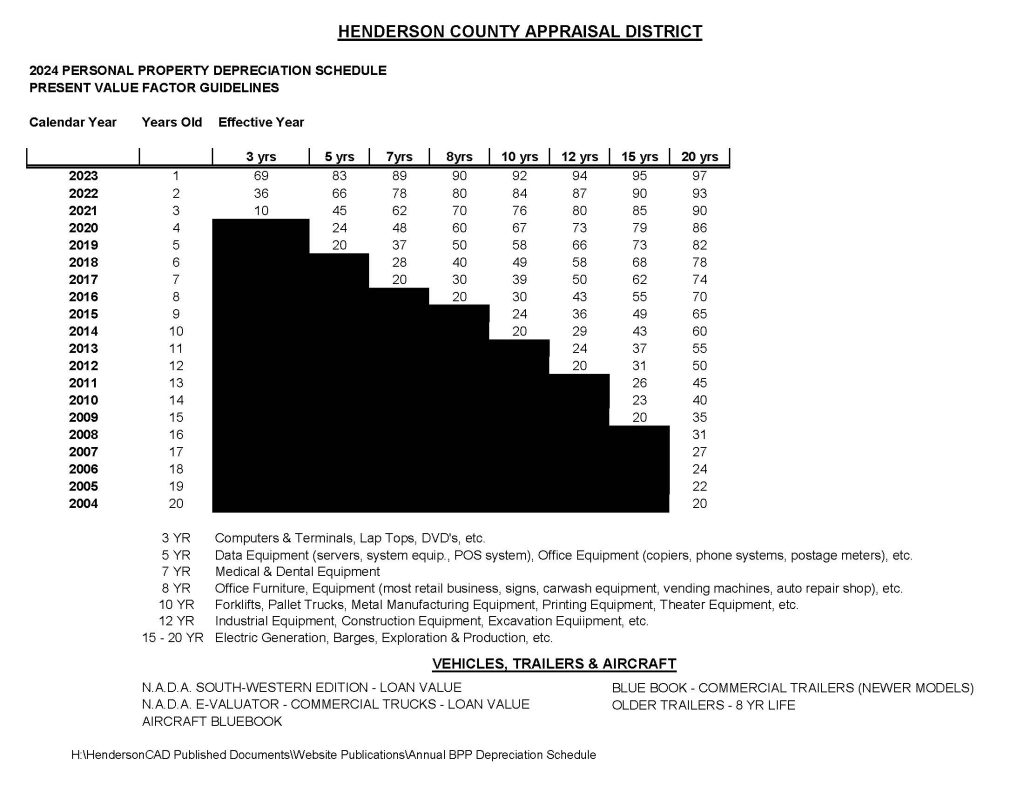

Source : www.forbes.com2024 Personal Property Depreciation Schedule – Henderson CAD

Source : henderson-cad.orgIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comA Guide to the QBI Deduction | Castro & Co. [2024]

Source : www.castroandco.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com2024 Schedule 1 2024 Deductions Federal Tax Filing Deadlines for 2024 420 CPA: Standard Deductions for 2023 and 2024 Tax Years Source are dollar amounts that are deducted from your AGI. Use Schedule 1 to report above-the-line deductions and calculate the total. . For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. .

]]>